Dennis Zogbi, Paumanok Inc. publishes on TTI Market Eye outlook on dynamic landscape of regional and key country markets for capacitors, resistors and inductors.

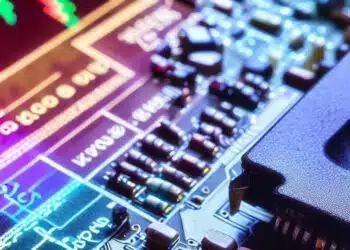

In FY 2023, regardless of region and key country, the passive component markets are reacting to a clear shift in consumption away from a pandemic economy to one focused on climate change (See Figure 1.). As a result of the shift, demand for passive components such as resistors, capacitors, and inductors is expected to remain strong.

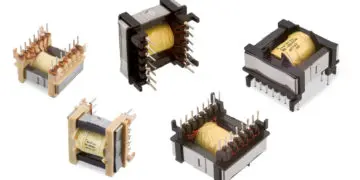

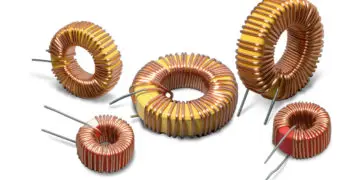

Global demand for resistors is expected to remain strong in FY 2023, due to an increase in the production of consumer electronics, automotive, and medical equipment. This is driven by a surge in demand for consumer electronics, as consumers look for more energy-efficient products. Demand for capacitors is also expected to remain strong, driven by an increase in renewable energy production and the need for better electrical energy storage. Inductors are expected to benefit from the increased demand for wireless communication products, such as Wi-Fi routers, as well as the increased demand for automotive electronics.

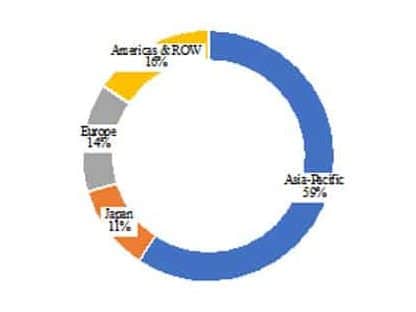

Regionally, Asia-Pacific is projected to be the largest consumer of passive components in FY 2023, followed by Europe and then North America. China is the largest consumer of passive components in Asia-Pacific, with India and Japan showing strong demand as well. In Europe, demand is expected to remain strong in Germany, France, and the United Kingdom. North America is projected to be the smallest market for passive components in FY 2023, driven by a decrease in demand for consumer electronics as well as automotive and medical equipment.

Overall, the demand for passive components is expected to remain strong in FY 2023, driven by a shift towards a more climate change focused economy. Global demand is expected to be highest in Asia-Pacific, followed by Europe and then North America.

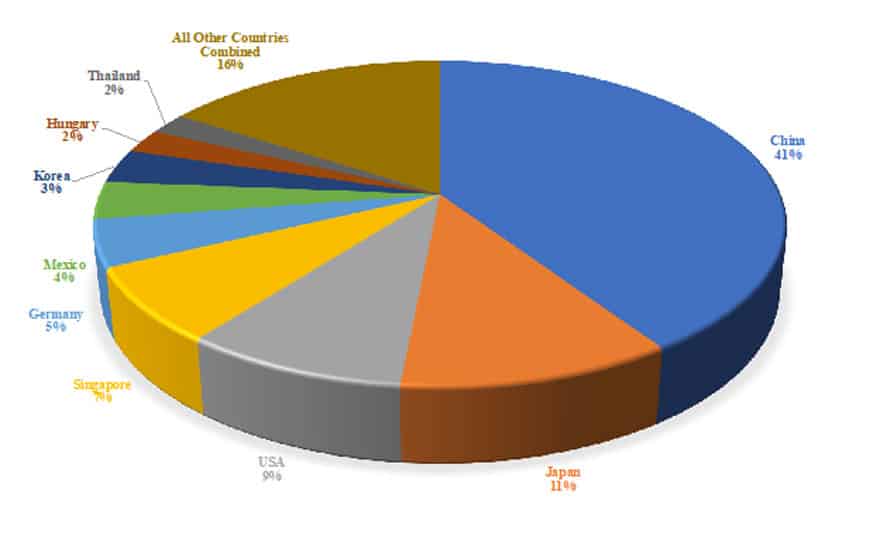

Asia-Pacific and Japan: FY 2023 Passive Component Consumption Value

SE Asia accounts for about 59 percent of the worldwide total consumption value for all passive components for FY 2023, while Japan accounted for about 11 percent of worldwide consumption for FY 2023 (i.e. total Asia is 70 percent. See Figure 2. for reference).

China, Japan, Korea, Singapore and Thailand markets are home to the massive wireless handset, computer and TV set markets, and the related sub-assemblies (i.e. power supplies, video cards) that drive demand for all passive components. The region represents considerable volumes of consumption opportunities for vendors of capacitors, resistors and inductors and almost all major passive component manufacturers have production facilities somewhere in China, or have support factories in Korea, Philippines, Thailand, Malaysia or Singapore.

China’s High-Tech Economy: Economic Outlook to 2028

China is a complex and rapidly changing economy, and predicting its economic outlook is challenging due to a variety of internal and external factors. One of the primary drivers of China’s economy is government policy, which can have a significant impact on economic growth and stability. For example, the Chinese government may choose to implement policies that stimulate domestic consumption or increase infrastructure spending, which could boost economic growth in the short term. However, policies that prioritize short-term growth over long-term sustainability could also lead to imbalances and risks down the road.

External factors can also have a significant impact on China’s economic outlook. China is a major exporter, and changes in global demand for Chinese goods can affect the country’s economic growth. Additionally, trade relations with other countries, particularly the United States, can have a significant impact on China’s economic performance. Disputes over trade, technology or other issues could lead to increased tariffs, reduced exports and decreased investment, all of which could harm China’s economy.

Technological advancements are another factor that could affect China’s economic outlook. China has made significant investments in research and development in areas like artificial intelligence, renewable energy, and biotechnology, which could position the country for long-term growth and competitiveness. However, advances in technology could also lead to disruption in traditional industries and job displacement, which could create challenges for China’s workforce and economy.

Also, global economic conditions, such as changes in interest rates, commodity prices or geopolitical tensions, could also affect China’s economic outlook. For example, a global recession could lead to decreased demand for Chinese goods and decreased investment, which could harm China’s economic growth.

China’s high-tech economy is expected to continue to grow in the coming years. The Chinese government has made significant investments in research and development, particularly in areas like artificial intelligence, biotechnology and renewable energy, which have the potential to drive long-term growth and competitiveness. China will continue to lead the world in areas like 5G, artificial intelligence and e-commerce, and that digital technology will play an increasingly important role in driving economic growth and innovation in the country. In addition to government investment, China’s high-tech economy is also supported by a large and growing pool of highly skilled workers, as well as a robust venture capital industry that is fueling innovation and entrepreneurship. However, there are also challenges facing China’s high-tech sector, including concerns over intellectual property protection, access to capital and increasing competition from other countries.

Overall, the forecast for China’s high-tech economy is positive, but the sector will need to continue to innovate and adapt in order to stay competitive in an increasingly globalized and rapidly changing economic landscape.

Japan’s High-Tech Economy: Economic Outlook to 2028

Japan’s high-tech economy is also expected to continue to grow in the coming years. Japan has a long history of technological innovation, particularly in areas like robotics, electronics, and automotive manufacturing. The Japanese government has also made significant investments in research and development, particularly in emerging fields like artificial intelligence, quantum computing and biotechnology.

However, Japan’s high-tech economy also faces several challenges, including an aging population, a shortage of skilled workers in certain fields, and increasing competition from other countries like China and South Korea. The government has implemented policies aimed at addressing these challenges, such as increasing support for education and training in STEM fields, promoting entrepreneurship and innovation, and encouraging foreign investment.

Overall, the forecast for Japan’s high-tech economy is positive, but the sector will need to continue to innovate and adapt in order to stay competitive in an increasingly globalized and rapidly changing economic landscape.

Japan is a global leader in electronics manufacturing, and there are many companies in Japan that consume electronic components.

Also, at this writing, the yen has increased to 140 per U.S. dollar making electronic components produced in Japan favorably priced and may impact demand and consumption.

Singapore’s High-Tech Economy: Economic Outlook to 2028

Singapore has made significant investments in its high-tech economy and is expected to continue to grow in this sector in the coming years. Singapore’s government has launched initiatives to support innovation, entrepreneurship and research and development, particularly in areas like artificial intelligence, advanced manufacturing and fintech.

Singapore’s high-tech economy is also supported by a highly skilled workforce and a business-friendly environment that encourages innovation and entrepreneurship. The government has implemented policies aimed at attracting foreign investment and talent, such as tax incentives and streamlined immigration procedures.

However, Singapore’s high-tech economy also faces several challenges, including a small domestic market, a shortage of skilled workers in certain fields, and increasing competition from other countries in the region. The government has launched initiatives to address these challenges, such as increasing support for education and training in STEM fields and promoting collaboration between industry and academia.

Overall, the forecast for Singapore’s high-tech economy is positive, but the sector will need to continue to innovate and adapt in order to stay competitive in an increasingly globalized and rapidly changing economic landscape.

Korea’s High-Tech Economy: Economic Outlook to 2028

Korea’s high-tech economy is expected to continue to grow in the coming years. South Korea has a strong technology sector, particularly in areas like semiconductors, smartphones, and display panels, and is home to several major technology companies like Samsung and LG.

This article identifies several key areas of opportunity for South Korea’s high-tech sector, including 5G, artificial intelligence and the Internet of Things.

Korea’s high-tech economy is also supported by a highly skilled workforce, strong government support for research and development and a business-friendly environment that encourages innovation and entrepreneurship. The government has implemented policies aimed at promoting innovation and entrepreneurship, such as tax incentives for start-ups and increased investment in research and development.

However, Korea’s high-tech economy also faces several challenges, including increasing competition from other countries like China and Japan, as well as geopolitical tensions in the region. The government has launched initiatives to address these challenges, such as increasing support for education and training in STEM fields and expanding the country’s network of free trade agreements.

Overall, the forecast for Korea’s high-tech economy is positive, but the sector will need to continue to innovate and adapt in order to stay competitive in an increasingly globalized and rapidly changing economic landscape.

Thailand’s High-Tech Economy: Economic Outlook to 2028

Thailand has been working to grow its high-tech economy in recent years, but it still faces several challenges in this area. The country has made investments in areas like digital infrastructure, biotechnology and robotics, but its high-tech sector is still relatively small compared to other countries in the region.

Thailand’s high-tech economy is also supported by a growing number of technology startups and a relatively low cost of living compared to other countries in the region. The government has implemented policies aimed at promoting innovation and entrepreneurship, such as tax incentives for start-ups and investment in research and development.

However, Thailand’s high-tech economy also faces several challenges, including a shortage of skilled workers in certain fields, limited access to funding for startups and a complex regulatory environment. The government has launched initiatives to address these challenges, such as increasing support for education and training in STEM fields and simplifying the process for starting and running a business.

Overall, the forecast for Thailand’s high-tech economy is positive, but the sector will need to overcome several challenges in order to reach its full potential and stay competitive in an increasingly globalized and rapidly changing economic landscape.

Europe: FY 2023 Passive Component Consumption Value and Country Outlook

The European market will account for approximately 14.0 percent of global consumption value for passive components in FY 2023. Germany and Hungary are among the top nine consumers of passive components in the world, however, other countries are included below, such as France. Holland and the UK because of their advanced electronics production and their high levels of supply chain profitability.

Germany’s High-Tech Economy: Economic Outlook to 2028

Germany has a well-established and highly developed high-tech economy, with a strong focus on engineering and innovation. The country has a long history of technological innovation, with notable contributions in fields such as automotive engineering, industrial automation and renewable energy.

The outlook for the German high-tech economy is generally positive. The country has a highly skilled workforce, a strong tradition of research and development and a supportive policy environment. Germany also benefits from its central location within Europe, which makes it a hub for international trade and investment.

In recent years, there has been a particular focus on digital technologies, with the German government and industry leaders investing heavily in areas such as artificial intelligence, cybersecurity and the Internet of Things. These investments are expected to drive growth and innovation in the coming years, as Germany seeks to maintain its position as a global leader in high-tech industries.

However, like many other economies, Germany faces challenges such as increasing competition from emerging economies, demographic changes and shifting consumer preferences. These challenges will require continued investment and innovation to ensure the continued success of the German high-tech economy.

Germany has a strong and vibrant electronics industry, with a wide range of companies involved in the design, manufacture and distribution of electronic components. Some of the top electronic component manufacturers in Germany include Bosch, Infineon Technologies and Siemens.

Hungary’s High-Tech Economy: Economic Outlook to 2028

Hungary has a well-educated workforce and a strong tradition in engineering and manufacturing, which has helped to attract investment from a range of high-tech industries, including software development, IT services, biotech and automotive manufacturing.

Here are some key factors contributing to the growth of Hungary’s high-tech economy:

Government support: The Hungarian government has been actively promoting the development of the high-tech sector through various initiatives, including tax incentives and funding for research and development.

Skilled workforce: Hungary has a highly skilled and educated workforce, particularly in the fields of engineering and technology.

Low labor costs: Hungary’s relatively low labor costs compared to other countries in the region make it an attractive location for high-tech companies looking to establish operations.

Strategic location: Hungary’s central location in Europe makes it an ideal location for companies looking to expand their operations in the region.

Access to funding: Hungary has a growing startup ecosystem, with a range of funding opportunities available from both government and private sources.

Overall, the outlook for Hungary’s high-tech economy appears positive, with continued growth expected in the coming years. However, like all economies, it is subject to various external factors such as global economic conditions, geopolitical risks and technological developments, which could have an impact on its performance.

France’s High-Tech Economy: Economic Outlook to 2028

France has a well-educated workforce and a long tradition in engineering, which has helped to attract investment from a range of high-tech industries, including software development, biotech and aerospace.

Here are some key factors contributing to the growth of France’s high-tech economy:

Government support: The French government has been actively promoting the development of the high-tech sector through various initiatives, including tax incentives and funding for research and development.

Skilled workforce: France has a highly skilled and educated workforce, particularly in the fields of engineering and technology.

Innovation and entrepreneurship: France has a vibrant startup ecosystem, with a growing number of entrepreneurs and investors supporting innovative new ventures.

Infrastructure: France has a well-developed infrastructure, including high-speed internet, world-class research facilities and a modern transportation network.

Strategic location: France’s central location in Europe makes it an ideal location for companies looking to expand their operations in the region.

Overall, the outlook for France’s high-tech economy appears positive, with continued growth expected in the coming years. However, like all economies, it is subject to various external factors such as global economic conditions, geopolitical risks, and technological developments, which could have an impact on its performance.

Holland’s High-Tech Economy: Economic Outlook to 2028

The Netherlands has a well-developed high-tech sector, with strengths in areas such as semiconductors, nanotechnology and renewable energy. Here are some of the key factors contributing to the growth of the Netherlands’ high-tech economy:

Government support: The Dutch government has been actively supporting the development of the high-tech sector through various initiatives, including tax incentives and funding for research and development.

Skilled workforce: The Netherlands has a highly skilled and educated workforce, particularly in the fields of engineering and technology.

Innovation and entrepreneurship: The Netherlands have a vibrant startup ecosystem, with a growing number of entrepreneurs and investors supporting innovative new ventures.

Infrastructure: The Netherlands has a well-developed infrastructure, including high-speed internet, world-class research facilities, and a modern transportation network.

Strategic location: The Netherlands’ central location in Europe makes it an ideal location for companies looking to expand their operations in the region.

Overall, the outlook for the Netherlands’ high-tech economy appears positive, with continued growth expected in the coming years. However, like all economies, it is subject to various external factors such as global economic conditions, geopolitical risks, and technological developments, which could have an impact on its performance.

UK’s High-Tech Economy: Economic Outlook to 2028

The UK has a strong high-tech sector, with a particular focus on areas such as fintech, artificial intelligence and digital health. Here are some of the key factors contributing to the growth of the UK’s high-tech economy:

High levels of investment: The UK has seen a steady increase in venture capital investment in the technology sector over the past five years, reaching a record high of £6.3 billion in 20This has enabled many innovative companies to develop and scale up their products and services.

A supportive government: The UK government has made a strong commitment to supporting the growth of the technology sector and has introduced a range of policies to encourage investment, research and development, and entrepreneurship.

A highly skilled and educated workforce: The UK has a large pool of highly educated and talented people, with expertise in a range of key areas such as software engineering, data science and machine learning.

Access to global markets: The UK has a highly developed infrastructure and is well-connected to global markets, making it a great place for companies to develop and export their products and services.

A world-leading digital infrastructure: The UK has an excellent digital infrastructure, with high-speed broadband and mobile networks. This provides companies with the tools they need to build modern, digital products and services.

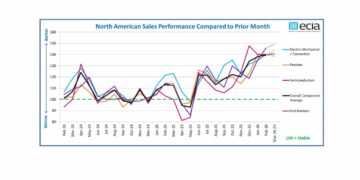

Americas: FY 2023 Passive Component Market Outlook

The Americas will account for approximately 16 percent of the global market for passive components in FY 2023 due to the significant strength of the U.S. dollar. The U.S. and Mexico and among the top consumers of electronic components in the world.

The Americas require parts for automotive, telecom infrastructure and industrial electronics markets; aerospace, spacecraft, medical and defense electronics all outperformed, as did an unexpected increase in demand for life science electronics for the testing of DNA. The strength of the U.S. dollar is having a major impact on financial data reporting by world region as the financial markets are in turmoil following pandemic easing and post-pandemic quantitate restrictions.

The reader should remember that American consumption of capacitors by dielectric resembles the end-markets in America into which they are sold, which is largely dictated by demand from the computer, automotive, telecommunications and specialty end-use markets. In computers, demand is largely dictated by capacitor consumption in computer subassemblies, primarily microprocessor chipsets and graphics cards; while demand from the automotive segment is for safety, drivetrain and driver infotainment. Demand from the telecom segment is for telecom infrastructure equipment, datacom infrastructure equipment and for chipsets sold to handset companies. Specialty segment demand includes a variety of smaller sub-segments where there are low volume, high dollar markets, such as defense, medical and downhole pump markets.

U.S. High-Tech Economy: Economic Outlook to 2028

The passive electronic components market in the United States is driven by the growth of the automotive, aerospace and defense industries, as well as the increasing demand for consumer electronics and IoT devices. The increasing adoption of electric vehicles and renewable energy systems is also expected to drive the demand for passive components in the U.S. in the coming years. The major players in the U.S. passive electronic components market include Vishay Intertechnology, TDK Corporation, Murata Manufacturing Company, and AVX Corporation.

The outlook for the U.S. high-tech economy is positive, despite the lingering effects of the COVID-19 pandemic. Here are some factors contributing to this outlook:

Strong demand for technology products and services: The pandemic accelerated the adoption of digital technology, resulting in a significant increase in remote work, e-commerce and online learning. This has led to increased demand for technology products and services, such as cloud computing, cybersecurity and e-commerce platforms.

Innovation and investment: The U.S. has a vibrant startup ecosystem and is home to many innovative technology companies. Investment in technology startups continues to grow, with venture capital funding reaching record levels in 2021. Major technology companies such as Amazon, Facebook, Google and Microsoft also continue to invest heavily in research and development.

Government support: The U.S. government has prioritized investment in technology infrastructure and innovation, with initiatives such as the National AI Initiative and the American Jobs Plan, which includes funding for broadband internet access, electric vehicles and clean energy technology.

Skilled workforce: The U.S. has a highly skilled workforce, with many universities and research institutions producing top talent in fields such as computer science, engineering and mathematics.

Competition and regulation: The U.S.’s high-tech economy is highly competitive, with many large technology companies vying for market share. This has led to increased scrutiny and regulation of these companies, with a focus on antitrust and privacy concerns.

American vertical companies consume electronic components for a variety of products and services, including computers, smartphones, servers, network equipment, cloud services and more. It’s worth noting that this list is not exhaustive, and there are many other companies in the U.S. that also consume significant amounts of electronic components.

Mexico High-Tech Economy: Economic Outlook to 2028

Demand for passive electronic components in Mexico is driven by the increasing adoption of digital technologies and the growth of the automotive and telecom industries. The demand for passive electronic components is expected to increase further as new technologies such as 5G and the Internet of Things become more widespread.

The Mexican government is actively encouraging manufacturers to invest in the country, due to its favourable cost advantages and labour availability. This has led to the entrance of several international companies such as Panasonic, Siemens, and NXP into the Mexican market. These companies have set up production plants to capitalize on the country’s cost advantages.

In addition, the increasing demand from the automotive industry has driven the demand for passive electronic components in Mexico. As the industry shifts towards the adoption of electric vehicles, the demand for passive components such as capacitors, resistors, and transistors is expected to increase.

The demand for passive components is also expected to be driven by the increasing adoption of IoT technology. IoT devices require components such as sensors and transducers, which will lead to an increased demand for passive components.

Overall, the demand for passive electronic components in Mexico is expected to grow in the near future, driven by the increasing adoption of digital technologies and the growth of the automotive and telecom industries.

Summary and Outlook

The reader will note that, regardless of component type, the overwhelming majority of demand for capacitors, resistors and inductors is centered in SE Asia, with emphasis upon Greater China (PRC, Hong Kong and Taiwan); however, the smaller Asian countries, including Korea, Philippines, Singapore, Malaysia and Thailand are also considerable markets. Europe, the Americas and Japan are smaller markets when compared to China and the SE Asia Region.

The reader should also note that the market size for capacitors, resistors and inductors is highly dependent upon the economic conditions of the region. In times of economic difficulty, demand for these components will decrease, while in times of economic prosperity, demand will increase. Additionally, the reader should be aware that regional trade agreements, such as the Regional Comprehensive Economic Partnership (RCEP) and the Trans-Pacific Partnership (TPP), can have a significant effect on the demand for capacitors, resistors and inductors, as they allow for increased trade between countries in the region.