by: Tomas Zednicek (1), Martin Bárta (2), Felix Corbett (2) and Jörg Frodl (2)

- EPCI, European Passive Components Institute; Czech Republic

- TTI Electronics Europe; Germany

presented by T.Zednicek and M.Barta at the 2nd PCNS 10-13th September 2019, Bucharest, Romania as paper 2.4.

ABSTRACT

Passive components market and supply chain has been under turbulent conditions recently with some shortage and limited supply issues especially on MLCC and resistors components. The paper will discuss passive components as a significant sourcing risk factor with need for especially capacitor supply chain optimization. The second part of the paper will focus specifically on MLCC trends, issues, performance, opportunities and further miniaturization options.

INTRODUCTION

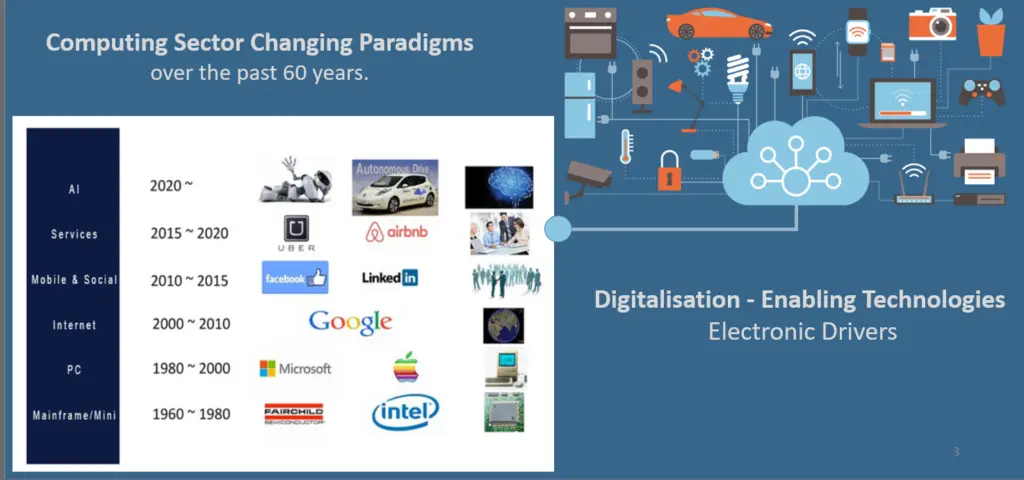

We are currently living in a fascinating time of transition into the new digital age of human history. The move is enabled by a fast development of electronics and computer segment bringing completely new level of networking and services in all aspects of our lives – see Fig.1.

The new level of digital based services and networking are enabled by new electronic hardware, technologies with high computing, data transfer or storage capabilities. The recent platforms such as IoT, IIoT/ Industry 4.0, 5G V2X… are calling for exponential increase of global data traffic and mobile data that the electronic hardware and infrastructure must support.

Major impacts to the electronic hardware requirements:

- wide increase of data to be processed on board

- move from RF to optical links (infrastructure)

- move from systems on PCB to system-on-chip

- higher density & integrated solutions

- digital, power, RF/optical signal interface to be managed within the same PCB/block, often with downsizing requirements.

- increase of dissipated power & operating temperature

- miniaturization – smaller and lower profile designs while maintaining/improving system performance

- cost & lead time reductions

Consequences for board design architecture changes:

- move towards wide gap semiconductor technologies (GaN/SiC) for higher speed, higher frequencies and higher operating efficiency at smaller dimensions.

- possibility to expand higher temp applications because of high operating capability of GaN/SiC semiconductors

- due to the high number of different functions and interface types, more and more different supply voltages will have to be managed separately

- multiplication of Point-of-Load and Low-Drop-Out regulator

- increase of electromagnetic compatibility constraints – protect very small digital control and data signals in increasingly noisy electrical environments

- lower voltages and higher current DC-DC converters

Consequences for passive components:

- low voltage, high capacitance, small size and low ESR decoupling capacitors (MLCC class II top of the interest)

- large capacitance, low voltage and low ESR bulk capacitors

- downsizing, embedding,

- thin film technology requirements

- 2D/3D printed components

- high current inductors

- overload protection by shunt resistors are mandatory

- EMI management

- introduction of 0402 RF inductors

- introduction of chip ferrite beads for power applications

references [1], [2], [3]

TRENDS & OVERVIEW

The global passive component trend shows growing investments into development of new processes and materials to introduce completely new generation of passive devices. This includes also investments into manufacturing equipment and technological know-how.

MLCC SMD capacitor technology has been the leader in discrete passive components miniaturisation, where 0201 case size has become the major case size in 2018 and smaller case sizes down to 008004 are step by step adopted by consumer electronics production nowadays. The sub 0201 and high CV components (>1000 dielectric layers per chip) commercialisation was enabled by a technological generation upgrade from thick film to thin films.

MLCC Market Situation

In 2018, we have seen dramatic increase of MLCC demand, followed by market disruptions and increase of price. Thanks to a recent softening in the global market, some relief in smaller case-size MLCC’s can be seen. Most suppliers report bookings slow down, and some more common parts are becoming more readily available. Automotive grade MLCC’s along with larger commercial grade components and high capacitance device continue to be either still on long lead time or controlled order entry. Legacy items continue to be constrained. European Market demand remains healthy particularly in Automotive and Industrial applications, where typically larger case size and high reliability are key. Automotive grade MLCC production continues to be fully booked until end of 2019 and according to many suppliers, automotive demand will continue to drive tight capacity for the next 2 years.

Downsizing Trends

According to the Paumanok Research, the current ceramic capacitor market is 17.1 BB USD and it is still expected to grow significantly. In order to meet the future demand, production capacity is being redirected to smaller, more economical case sizes for those standard CVs. Various manufacturers reported that 0201 became the major MLCC case size in 2018 and it is expected to become mainstream in 2023 and end customers are being advised to downsize where possible to avoid future supply issues. [4]

This, however, applies to global market whereas in Europe, the electronics industry mix differs significantly from these in Asia and typically require higher reliability or voltages. MLCC larger case demand stays vital.

Larger MLCCs Sales Stay Vital

Several larger suppliers have decided to limit production of less profitable commodity products, due to the limited return on capacity investment. Despite the global downsizing trends, demand for larger size MLCCs remains strong in Europe.

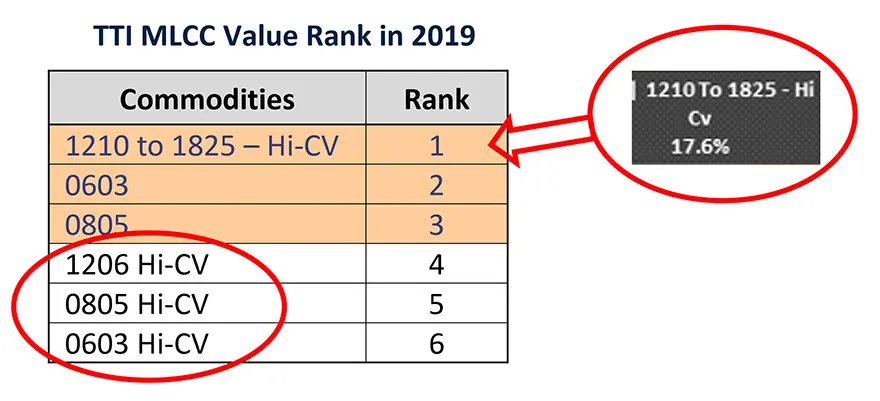

Based on TTI records, we do see some shift to smaller case, and the small sizes growth is also higher in percentage (0201 being the fastest). But in fact, our top 6 (in € value) MLCC categories are all larger case sizes, typical for the European Industrial and Automotive market and represent more than 60% of our MLCC business.

Hi CV MLCC

High capacitance ceramic capacitors are usually defined as values over 1uF. The ever-increasing capacitance continues to move deeper into the electrolytic capacitor market. The Hi-CV supply base is, however, limited to smaller number of manufacturers.

In Europe, X7R is the most used dielectric by far. In this arena is the supply base for the highest capacitance values even more limited. Future advancement of the X7R MLCC technology takes long periods of time and requires significant investments. Hi-CV MLCCs supply chain is expected to have shortages to 2020 and beyond. Currently the most critical are the well-known capacitance values 2.2uF / 4.7uF / 10uF / 22uF and 47uF in combination with the voltage value. Most tight are 25V & 50V, in larger case sizes and automotive grade. Using such values in new designs means competitive advantages for the OEMs, but also potential supply issues if the sourcing is not secured.

General Capacitor Trends

The general recent trends in capacitor (and other passives) technologies can be summarised into the following directions:

- Integration into IC chips

- Embedding and Embroidering

- 3D structures

- New materials and Technologies

- Optimisation of mass volume technologies

- Harsh environment capable robust designs

- Range extension and Downsizing

- High power (lower ESR, ESL …)

- New generation of thin film technologies for higher end applications

- Cost saving

Some capacitors “World first” features and parameters enhancements released in 2018/19 includes:

- Smaller DC link film capacitor

- 100kV film capacitors

- Film foil for temperatures up to 150C

- 1000uF MLCC capacitor 2.5V

- 10uF 100V 3525 MLCC capacitor

- Low ESR soft termination MLCC

- BME MLCC qualified to space

- 175/200C MLCC automotive

- World smallest 008004 MLCC capacitor

- C0G MLCC up to 200C

- 1000V 0603 C0G and X7R MLCC

- Tantalum polymer qualification at automotive or aerospace environment

- 30G vibration ready aluminium capacitors for automotive

- Glass to aluminium seal suggests Al El and Supercap reliability enhancement

- 85C 2000hrs and 85/85 1000hrs ready supercapacitors

- 3V (LiIon coin battery) ready thin supercapacitor

- Stretchable and flexible supercapacitors

- Up to 150C or down to -80C capable supercapacitor

- Reflowable chip supercapacitor

- Supercapacitor under space qualification

APPLICATION HIGHLIGHTS

Consumer – Handhelds

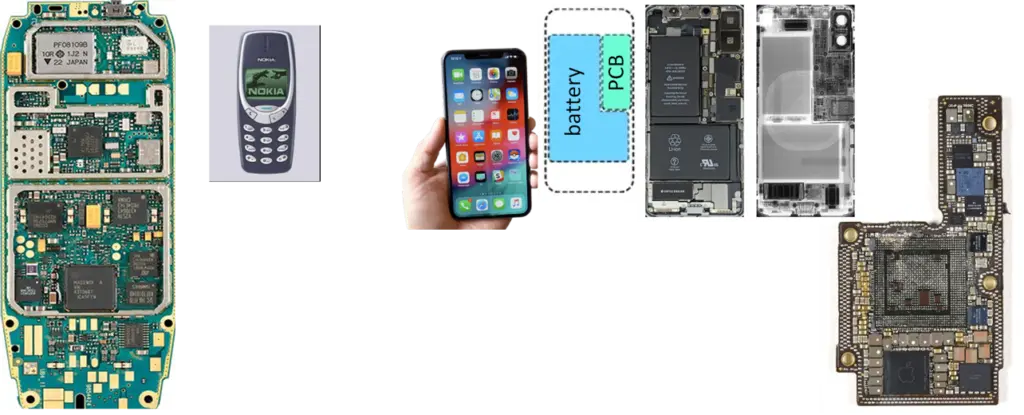

The need for PCB miniaturisation, advances in semiconductor and circuit architectures practically eliminated the need for capacitors larger than 0402 in smartphones. The requirements are moving towards smaller capacitance values, lower ESR and high ripple current to be able to support processor power needs. Majority of capacitors on board of the current smartphones are based on MLCC class I or class II technology due to its downsizing capabilities.

The level of miniaturisation in mobile phone industry is demonstrated in Fig.2. The Nokia 3310 mobile phone was announced on 1 September 2000 being one of the most successful phones with over 126 million units sold worldwide and being one of Nokia’s most iconic devices. Its PCB electronics occupies whole footprint area of the mobile phone with multiple “large” tantalum capacitors 7.3×4.3×2.0mm. Battery pack was placed under the mobile phone back cover and together with the PCB the overall phone thickness was about 15mm.

Apple iPhone X smartphone was released in September 2017. ¾ of its inner space is occupied by battery and only ¼ is left for the 20-layer PCB that integrates all functions. There are about 1100 MLCCs on board (no large capacitors such as tantalum), some of them are even embedded underneath decoupling the processor – as visible in Fig.3. PCB image with removed A11 processor.

Aerospace & Defence

Space industry is going through a significant change of move from so far dominating government orders to a private space business. Commercial space projects for telecom satellites, broad internet access or space transport missions are representing more than 50% of space business today. This transition brings a high motivation for faster adoption of the latest technology into the space hardware and shortening of evaluation & qualification phase for new technologies. Radiation hardness is the key issue to be addressed on active components, while requirements for lead termination soldering is the main barrier to adopt available commercial/automotive grade passive components “from the stock”.

During 2018 BME MLCC technology was fully adopted to the space qualified level, while still extension of PME MLCC technology is going on.

Tantalum wet capacitors are getting multisource at MIL level. Tantalum polymer capacitors moved to EPPL evaluated level at ESA and its multianode lower ESR version is going through qualification.

Aluminium capacitors with hermetical sealed package are trying to enter the defence and aerospace business claiming advantages (and lower cost) over tantalum capacitors. New glass to aluminium sealing developed by Schott is considered as a new potential to support this idea.

The recent evaluation and qualification activities includes utilisation of supercapacitors potential at space and harsh defence environment. Supercapacitor technologies demonstrated its capability to operate up to 150C under certain conditions, down to -80C temperature range or reflow-able chip package construction.

Automotive

Automotive industry is one of the most targeted application among the passive component development. The basic segmentation is cabin electronics (telematics, infotainment and entertainment, airbag + safety, communication, networking, etc.), under the hood (driving assistance, ABS, ESP, safety systems…), engine compartment (alternators, battery management, CPU, engine control sensors, inverters, start-stop system, etc.).

The new challenges are driven by regulation and standard requirements (emission, safety), enhanced communication platforms and also by the upcoming new generation of EV and HEV vehicles with new specific requirements.

In the automotive and on-board automotive-related areas, the performance of equipment such as advanced driver assistance systems (ADASs) is progressing together with the advancement of space-saving mounting parts to ensure comfortable vehicle interiors. To this end, even individual passive components must conform to harsh environments (temperature range, vibrations, moisture), miniaturization and high-performance requirements.

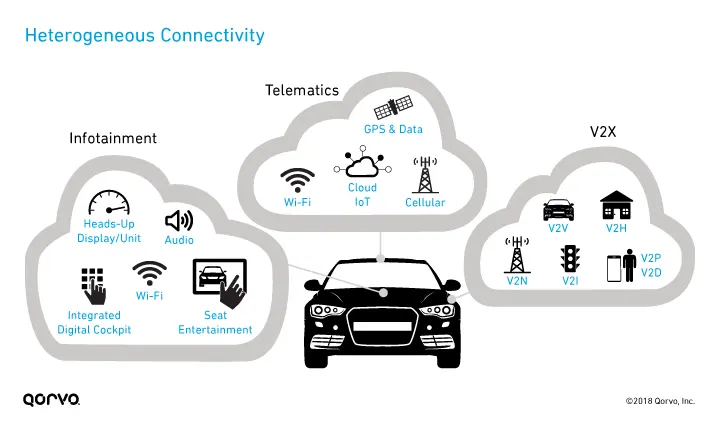

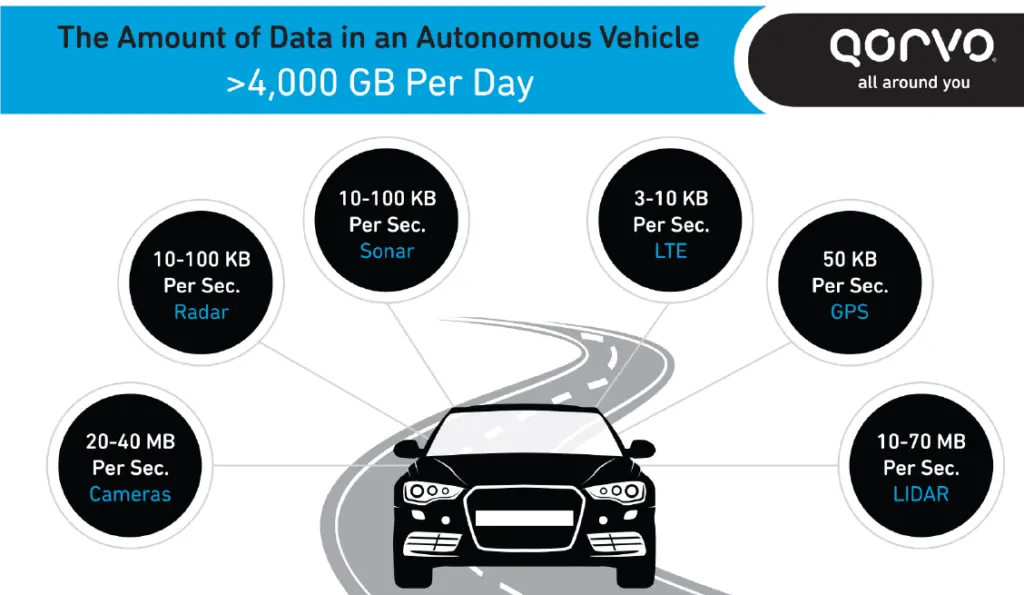

One of key trends in automotive is a fast expansion of data communication and data handling associated also with requirements for high computing power capabilities. Vehicles are becoming their own clouds, high data cloud storage and supercomputers. There are number of communication requirements within the vehicle environment – to the traffic infrastructure (V2I), network (V2N), homes and smart cities (V2H), pedestrians (V2P) and vehicle to vehicle (V2V). In common, all the communication with environment is covered under “vehicle to everything” (V2X) term. See Fig.4.

“Connected” cars, and especially the next autonomously driven cars, are becoming the prime IoT connected device with higher bit rate then smartphone and thus the prime business focus to current network providers. There are many new applications, protocols and carriers, BUT limited bandwidth. Data download demand will increase dramatically over the next five years exceeding 1Gbps download and it will significantly increase RF content and complexity. 5G sub 6GHz will be implemented but has to be relied on in low latency mode as the vehicle will have to keep it’s decision autonomy. The amount of data in an autonomous vehicle may exceed > 4,000 GB Per Day.(see Fig. 5.)

The above requirements are causing some shift in component technology selection guidelines. Film capacitors are under pressure to be replaced on-board by MLCC due to size, life and temperature limitation. We can see some latest releases from film capacitor manufacturers, towards higher temperature automotive grade products but still limited to 125C at high side, whereas the MLCC just released 175/200C automotive qualified range, or specific humidity resistant series. Vibrations and mechanical robustness presents a challenge for MLCC capacitors on the other hand.

Tantalum polymer capacitors are now available in automotive grade level capable to withstand 85/85 1000hrs life test, qualified to AECQ-200 requirements. New series of automotive grade aluminium electrolytic capacitors guarantee resistance to 30G vibrations.

Aluminium electrolytic capacitors with polymer electrolyte did not get a good reputation due to its DCL instability issues after board mounting. Nevertheless, the “advanced, hybrid” technology combines polymer and liquid electrolyte together to provide more robust solution ready for automotive use. The hybrid aluminium capacitors are now recommended as a superior lifetime and stable parameters option by manufacturers for wide range of automotive and industrial applications.

Industrial

Industrial electronics is a wide area of applications from a standard operation environment to the most demanding requirements for reliable components operations. Unlike automotive, where electronics is most of the lifetime in “off” state, or aerospace that after assembly, vibration launch the components are operating in non-humid, non-oxygen degradation environment, the industrial applications often require more than 10years 24h/7/365 days’ operation without a defect at harsh conditions such as low/elevated temperature, high humidity, salt atmosphere etc.

The key passive component trends are downsizing, enabled by use of “super-materials” or “super-technology”, parameters range extension or reinforcement of robustness and life at harsh conditions.

This can be illustrated by the recent release of TDK smaller DC-link film capacitors, extensions of max voltage range of Aerovox film capacitors up to 100kV or new 200/230C high temperature tantalum wet capacitors for oil drilling wells.

A specific topic of interest is generation, transportation, storage and harvesting of energy from nano-scale on chip solution up to high power energy applications. The top of interest is storage of energy for EV/HEV vehicles, recuperation, high energy power bank systems, for renewable energy or power networking storage etc. The recent releases include ruggedized, high energy storage supercapacitors with record storage energy densities, but also a development of new dielectric types for direct ~1kV voltage.

Medical

Medical electronics can be split into basic segments as follows:

- Life supporting (Yes-No)

- Implantable (Yes-No)

- Wearable (Yes-No)

The above segmentation is a key decision-making factor for selection of proper passive components. In example – implantable, life support defibrillators are using tantalum wet capacitors with the highest energy density, while external AED devices rely on larger, but reliable film capacitors. Non-life supporting, but high-reliability performance capacitor solutions can be represented by a special series of chip tantalum capacitors with improved reliability, lower DCL or higher surge robustness.

Energy harvesting and powering of wearable electronics is enabled by the latest supercapacitors that can offer ultra slim design or in upcoming generation promise stretchable, flexible construction suitable for “smart” clothes implementation including wash resistance capability.

AROUND AND BEYOND THE CURRENT TECHNOLOGY HORIZON

A next development potential for the next generation of passive components can be found in the following areas:

- Nano-Scale storage. On-chip storage in nano-scale can be beneficial for small energy harvesting chips. Some university development of nano-scale capacitors is aiming this application already.

- High Voltage High Energy Storage. Automotive EV/HEV market is in need for 400-1000V high energy, high volumetric efficiency storage capacitors. High energy storage capacitors are also needed by power electricity regenerative energy storage fields.

- Thin Film Capacitors – thin film technology may be necessary to answer needs for wearable sensors and electronics and further miniaturisation.

- 3D Printed Capacitors. 3D printing technology is rapidly developing, enabling new capabilities of 3D space free space new construction ideas not achievable by the current technologies. 3D PCB printers are already commercially available ready to print new architectures of antennas or RF ID sensors.

SUMMARY AND CONCLUSIONS

Miniaturisation, high speed data communication, increase of computing power, energy generation, transmission and storage are the main drivers for next generation of electronics. These requirements may induce some dramatic market changes challenging the passive components development & selection guide. It may require some parameter improvements such as increase of operating temperature, vibration & harsh environment resistance, lower ESR, lower ESL etc that is achievable only by replacement of capacitor technology used at the application for decades.

Consumer market is the largest among the electronic applications with continuous growth, on the other hands, the “traditional” segments such as smartphones, digital cameras, PC computers, notebooks, tablets etc are beyond its mature stage with decline in sold pieces. The highest market dynamic is currently seen on automotive electronics and telecommunication/networking infrastructure, that are now on top of the radar screen of number of passive component manufacturers. Passive component makers are also more and more concentrating on development of a complete module solutions rather than development of individual components.

MLCC ceramic capacitor technology answers best the need for further miniaturisation and high-volume production capability to support smartphones and other handhelds. The MLCC market is expected to grow in various industry fields. Larger case size, higher power, higher reliability (e.g. Auto grade) or specialty MLCC products are still on long allocation or controlled order entry. Automotive grade MLCC production continues to be fully booked until end of 2019 and demand is expected to continue to drive tight capacity for the next 1-2 years. Hi-CV MLCCs supply chain is expected to have shortages to 2020 and beyond.

REFERENCES

- Airbus Defence and Space Roadmap for Passive Components; ESA SPCD 2018; https://passive-components.eu/airbus-defence-and-space-roadmap-for-passive-components/

- Thales Alenia Space Passive Components Roadmap 2018; ESA SPCD 2018; https://passive-components.eu/thales-alenia-space-passive-components-roadmap-2018/

- Design Trends in Automotive Passives; Avnet Engineers Insight; https://passive-components.eu/design-trends-in-automotive-passives/

- Paumanok Publications; MLCC Shortages FY 2019 – Tier-To-Tier Strategies and Alternative Reference Designs

more 2nd PCNS symposium technical papers can be viewed and downloaded in pdf from EPCI Academy e-Proceedings:

Discussion about this post