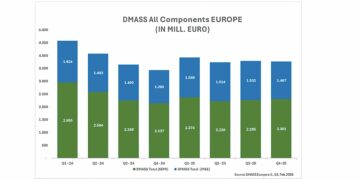

German magazine Markt & Technik published an interview by Engelbert Hopf with Tomas Zednicek Ph.D. about European passive electronic market outlook and expectations for 2024.

In view of various challenges on a global and national level, Dr. Tomas Zednicek, founder and president of the European Passive Components Institute (EPCI), does not expect the market to grow again until autumn. Until then, the price level will still remain above pre-covid levels.

Markt&Technik: Dr. Zednicek, in your opinion, what is the current situation on the European market for passive components? Are overcrowded warehouses at distributors and customers currently blocking follow-up business?

Dr. Tomas Zednicek: In my view, the current situation on the European market for passive components is mixed. On one hand, there is a clear oversupply of components, with distributors and customers reporting that their warehouses are overflowing. This is due to several factors, including the slower post-pandemic recovery, the war in Ukraine, subsequent high energy cost crisis and the global semiconductor shortage. These factors present on the market already for some time – after strong year 2021, there was a correction during 2022 and very cautious year 2023. Manufacturers in Europe are still faced with headwind of considerably high energy costs. Importers must adopt higher transportation cost and logistic/supply chain disruptions under the current geopolitical vibrant environment (such as the current conflict in Red Sea).

However, there are some signs that the situation may be starting to improve. In recent months, there have been reports of some distributors starting to clear out their excess inventory, and prices for some components have begun to stabilize. In USA ECIA North American electronic component survey showed strong optimism in January 24 across all three reporting segments (manufacturing, distribution, representatives) that serves a good confidence and positive mood towards 2024. In addition, specific products in highest growth segments such as power electronics may still be faced with some longer lead-times and supply chain challenges.

The industry is still very cautious, as it seems that the current geopolitical considerations have a stronger impact to the market outlook than our capabilities to forecast. On the other hand, growing demand for electronics due to electrification of transportation, energy (re)generation and storage or AI computing power requirements is present here, and it will be driving the requirements at for the current decade – unstoppably. Thus, I do not consider that the current market situation would have a major limitation impact on follow-up business growth.

In principle, this depletion of stocks is a completely normal situation after allocation periods. How long do you think it will take for the stocks in Europe to run out and for the demand situation to normalise again?

We do not know how long the current supply chain disruptions will take and to what extent it will affect the current slowly recovering market. Nevertheless, we can hope that the situation in Europe could start to normalize during the second half of 2024. We may see some improvements in US market soon that will be followed by Europe as well later. Distribution and customers may see signs of increasing demand during Q2 2024 with a good Autumn 2024 hope for manufacturers.

According to your observations, are there differences between individual countries in Europe? How important is the transformation process that the European automotive industry is currently undergoing for the current situation? How do you assess the situation in the industrial electronics sector?

The energy crisis impacted most the traditional high energy-dependent industrial countries such as Germany or Czech Republic, where recovery is more painful and taking longer time. Considering inventory, Germany is a major manufacturing hub for electronic devices with large number of distributors and customers who demand a wide variety of passive components. Thus, it has also the largest passive components market inventory in Europe followed by France and Italy that together has about the same level inventory as in Germany.

Electrification of transportation is one of the mega trends for electronic components and present key challenge for Europe to cope with and compete globally – from infrastructure, through micro-mobility, electric vehicles, automated unmanned vehicles to trucks or electrical planes. European automotive industry is on a milestone crossroad facing challenges on multiple levels. With current de-coupling of supply chains, global presence in time of de-globalization, on-time delivery during supply chain disruptions and lower entry barriers for newcomers it’s difficult to learn how to dance with more partners at the same time and stay competitive. This is of course true also for electronic component manufacturers down to the supply chain level. In my view it is time to put more emphasis on local/regional economy with sustainable supply chain and I wish the European automotive would play the role as an architect or orchestrator of this transformation. In the current market situation, it is important to keep and build relationship, share plans, discuss future needs as a basis for longer-term co-operation.

Automation of industry is the other mega trend in electronics growth of the decade. Industrial electronics may contribute as well to demand for the new advanced high-tech components and thus participate in re-vitalization of the current supply chain constrains. Energy savings, manual jobs replacement, quality or manufacturing flexibility are driving quick adoption of automation and robotics by industry answering number the current market hurdles and condition to stay competitive in Europe. This is associated with use of higher added value component requirements such as sensors, actuators, controllers, embedded systems, or power electronics.

Manufacturers have now started to reduce component production. Do you anticipate a massive bullwing effect? When do you think this will occur?

Of course, the risk of bullwing effect is there in such market situation, but I consider it is not likely to happen in large scale. I feel, we are not in a conventional market situation as we know it from marketing books or experience. Supply chain is very cautious, decision makers thinking twice over each strategy and trying to leverage its risks. So, this time I would more bet on slower step-by-step recovery unless there is a major supply chain disruption.

Follow-up question: In the meantime, some believe an even more massive allocation is possible from 2024/25 because, among other things, the owners of smaller manufacturers who made excellent profits during the coronavirus phase are asking themselves whether they should now exit, close the company or sell it. And in this way, the supply will narrow even further. Do you think these considerations are too “fanciful”?

There may be some truth on the background of these worries, however, the question is to what extend this will impact the overall market condition. Small manufacturers often produce specialized or niche components that are not easily replaced by larger manufacturers. As a result, their exit could leave a void in the market that could take some time to fill. This can be painful now especially in some industrial electronics. Nevertheless, typical niche markets such as defense, aerospace or medical may show healthy continuous growth in upcoming decade. Thus, there may be favorable conditions to keep / transform production of passive components by SMEs in these segments as a viable healthy business. Automotive shall be also excluded from the major risk areas as car manufacturers, especially European based, insists on multisource of its components and it shall not be dependent to small, niche supplies.

In your opinion, what is the current price situation? Are prices approaching those before the coronavirus pandemic again, or do you think this is impossible given the investments made in expanding production capacity during the crisis? In your opinion, how high are prices currently above the pre-corona level?

Passive component prices in Europe have come down from their peak levels during the coronavirus pandemic, but they are still mostly 20-30% above pre-pandemic levels. There are couple of factors that contributes to it:

- The oversupply has put downward pressure on prices, but it has also made it difficult for manufacturers to raise prices too quickly.

- The ongoing supply chain disruptions: These disruptions have made it difficult for manufacturers to source raw materials and components, which has also contributed to higher prices.

- The rising cost of labor and energy: These costs have also put pressure on prices.

Passive component prices may continue to come down in the coming months, but it will be difficult to match those pre-pandemic times. Demand for passive components is expected to pick up as the economy recovers and then as demand increases, manufacturers will be able to raise prices again without fear of losing customers.

The most recent, multiple challenges of recent times include the impact of the Gaza war on the container shipping situation in the Red Sea and the Suez Canal. Plus the recent earthquake in Japan. Are you already seeing the effects of these two events on the supply situation in Europe? Will this affect the European electronics industry with a time lag?

These are good examples of considerable supply chain disruptions that is difficult to forecast and measure immediate impact to the industry. The Suez Canal and Red Sea is a vital shipping route and bottle neck for many industries, including electronics, and any disruption to its operations can have a ripple effect throughout the entire supply chain.

The impact to Europe may be visible both short and longer terms. For example, Tesla and Volvo already announced some EU production interruptions in relation to the delayed parts from Asia that in consequences may impact wide supply chain. It is difficult to predict when the tensions in the region will ease and the additional time for ships at sea going round Afrika mean that distributors and customers had to hold more inventory longer term, which put upward pressure on prices.

If you look beyond 2024, what do you think would be necessary above all for the situation in the German and European component industry to normalise again, especially in the area of passive components? Do you see any signs of this, for example in the political arena?

As mentioned, mega trends in electrification of transportation and automation pose opportunity for passive component growth in Europe. Apart of wide range of standard components, state of the art components will be needed to design competitive systems with high efficiency, power density, sustainability, and performance.

Passive components have been for long time the overlooked as “simple”, “boring”, “not-to-bother” components. While the mood still presents among the universities and hardware designers, I see some positive movement in R&D activities in both academia and component manufacturers in recent years. I hope this will yield in new generation of integrated passive components based on wafer technologies, novel dielectrics based on emerging novel nano-material science technologies or advanced chemicals based on nano-chemistry engineering. Using pareto logic, while there still be sales of 80% of conventional passive components these new technologies will occupy 20% of the market making 80% of its future value. Shifting the over-mature passive business to the higher added value would be the best answer to the current market situation.

And comment to the political arena? Europe is currently hot for the silicon independency deal. That is indeed a great incentive after EU lost considerable manufacturing capabilities and fall under dependency to non-European sources. However, will we find out later that despite semiconductors are made in Europe again we still may not be able to make critical electronic boards in EU due to non-EU origin passives? As inspiration – Japanese version of EU-semiconductor act add MLCC as the strategic industry item to support its Japan domestic industry in 2023 – see details in this article Japanese Government Plans to Designate MLCC Ceramic Capacitors as Critical Goods.

Read the original interview in German language here: